Welcome back to the THRIVE articles!

When it comes to finances and budgeting, there is a lot to think about, and sometimes it can feel super overwhelming! As a student there is lots to factor in such, as:

- Course fees

- Study materials (textbooks, stationary, devices etc.)

- Transport

- Rent

- Food

- Relocation costs

It’s because of this, that it’s important to have good financial wellbeing. Financial wellbeing is being able to meet your financial obligations and still have the freedom to save and manage unexpected costs. You can still have good financial wellbeing even on a student budget!

Financial wellbeing and mental health are linked because every day we make choices with our money, and each choice (whether big or small) will have an influence on our lives.

Rest assured, this week’s article will bring you some tips and tricks on how to budget and where to find the best resources to get started!

“Not having money to spend doesn’t mean we can’t have well-spent moments every day”

– Sarah Ban Breathnach

Below are some tips for budgeting to suport your financial wellbeing.

- Know where your money is going.

- Try tracking both your income and expenses for a month, while noting down your regular expenses that are a must (e.g. rent, groceries, transport, bills, medical expenses). This will help you visualise how much money you have left for saving or treating yourself.

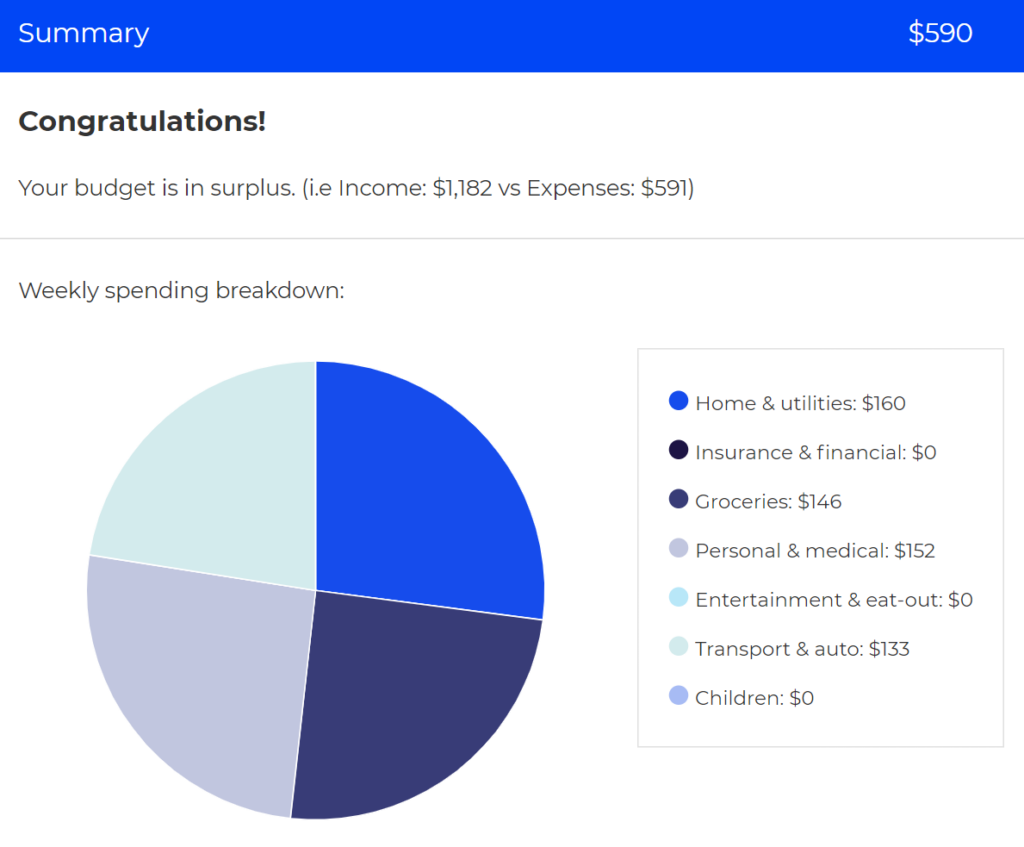

- Use the moneysmart budgeting tool.

- Also compare how often you spend money on non-essentials (e.g. takeaway food and drinks, online shopping, subscriptions) and formulate a plan to reduce these expenses. A great solution is to find no-spend activities (such as hikes or swimming) so that you don’t miss out on seeing your friends.

- Try a subscription management app.

- Set your budget.

- Now that you understand your income and expected expenses, you can now budget how much you will save and how much you may use to treat yourself. It is also completely okay to decide you don’t want to spend money treating yourself if you want to save more.

- Research bank accounts.

- Look for a daily transaction account with no fees. Many banks offer this for young adults and also students.

- Find a savings account with a suitable interest rate that will reward you for saving.

How can I reduce my expenditure?

There are lots of ways you can save money, and minimise your expenses. Here is a small list that you could start with!

- Purchase second-hand textbooks.

- Research fresh produce that is in season, and purchase accordingly. Sometimes, frozen vegetables are cheaper (and still just as nutritious!).

- Identify needs vs. wants, and focus on putting your money towards the ‘needs’.

- Use student discounts (such as Medibank OSHC, Student Beans, UniDays).

- Don’t do your grocery shopping when you’re hungry, because you will be more likely to buy more food than you need. It also helps to meal plan and write down a list of everything you need to help you focus on what you actually need to buy. If you don’t want to eat the same thing all week, plan two bulk meals and freeze half of both to eat at a different time.

- Pack your lunch (and snacks!) to uni. The easiest way to do this, is eat your leftovers for dinner. Not only will you save money, you’re also reducing food waste at the same time!

- Explore your banking app. These days, many banks include budgeting tools and features within their apps.

- Review your subscriptions and memberships to see if you can choose a cheaper plan that still suits your needs.

Staff Profile

Name: Soutara

Role: Health Promotion Officer

Share one thing you wish you knew about budgeting.

That it is actually okay to say no sometimes to going out with friends, because we all have different priorities and budgeting needs! There are still lots of fun and free activities to do, and there is nothing wrong with asking to do something that doesn’t cost any money. Going through uni, I was always afraid of having to say no because I was trying to save money and would always make up random excuses or pick up a shift at work instead so that I felt like I had a ‘legitimate’ excuse.

What are 5 fun, and low-cost things to do around Sydney?

- There are so many lovely parks that you can go to for a walk and catch up with friends

- Gym sessions with friends! Many gyms have free trials or bring a friend for free days, so why not go together one day?! If you both have a membership to the same franchise gym (e.g. Anytime Fitness, Plus Fitness) then many of these give you access to any location which is a huge bonus so why not choose a location to meet at and train together?!

- For some of you, studying together may be enough! Going through uni, my favourite thing was hanging out with my friends in the uni library. It meant we could not only encourage each other to stay focused and achieve our tasks, but then we could break for lunch and chat for a short period before returning to the library.

- Board Games! I love a good board game afternoon with friends. Take turns at hosting and everyone brings a board game each to play.

- Check out all the free events across the road at UNSW main campus! There are always plenty of events happening and usually it involves free food!

Featured Events

THRIVE Thursday

Date: Thursday 15 February

Time: 12pm – 1pm

Location: Room LG15, Lower Ground Level, L5 Building, UNSW College

Aussie Food Tasting

Date: Thursday 15 February

Time: 1pm – 2pm

Location: Room 131, Level 1, L5 Building, UNSW College

Bike n’ Blend

Date: Friday 16 February

Time: 12:30pm – 2:30pm

Location: Courtyard, Level 1, L5 Building, UNSW College

SEA LIFE Sydney Aquarium

Date: Saturday 17 February

Time: 10:30am – 12:30pm

Location: 1-5 Wheat Rd, Sydney NSW 2000

Fortnightly Program

International Mother Language Day

Date: Wednesday 21 February

Resources

Disclaimer: This is not official financial advice and students should contact Student Wellbeing Advisers or consult an independent and legal finance professional before making any serious financial decisions.